Cybersecurity Insurance for Small Businesses: Protecting Your Digital Assets

In today's digital age, small businesses are increasingly reliant on technology to operate and grow. However, this reliance also makes them vulnerable to cyberattacks. A single data breach or ransomware attack can cripple a small business, leading to financial losses, reputational damage, and even closure. That's where cybersecurity insurance comes in. It’s a crucial safety net for navigating the complex landscape of digital threats.

What is Cybersecurity Insurance?

Cybersecurity insurance, also known as cyber liability insurance, is a type of insurance policy designed to help businesses recover from financial losses resulting from cyberattacks and data breaches. It provides financial assistance to cover expenses related to incident response, legal fees, notification costs, and more. Think of it as a financial shield against the ever-growing cyber threat landscape.

Why Do Small Businesses Need Cybersecurity Insurance?

Many small business owners mistakenly believe they are too small or insignificant to be targeted by cybercriminals. However, this is a dangerous misconception. Small businesses are often seen as easy targets because they typically have fewer security resources and less sophisticated cybersecurity defenses than larger corporations. Cybercriminals know this and actively target them. Here’s why cybersecurity insurance is essential for small businesses:

- Increasing Cyber Threats: Cyberattacks are becoming more frequent and sophisticated, making it more important than ever for businesses to protect themselves.

- Financial Losses: The cost of recovering from a cyberattack can be significant, including expenses for data recovery, legal fees, and business interruption.

- Reputational Damage: A data breach can damage a company's reputation, leading to a loss of customers and revenue.

- Legal and Regulatory Compliance: Many industries are subject to regulations that require businesses to protect sensitive data. Cybersecurity insurance can help businesses comply with these regulations.

- Peace of Mind: Knowing that you have cybersecurity insurance can provide peace of mind and allow you to focus on running your business.

Understanding Cybersecurity Insurance Coverage

Cybersecurity insurance policies can vary widely in terms of coverage, exclusions, and premiums. It's crucial to understand the different types of coverage available and choose a policy that meets your specific needs. Here are some common types of coverage included in cybersecurity insurance policies:

Data Breach Response Costs

This coverage helps pay for the costs associated with responding to a data breach, such as:

- Forensic Investigation: Hiring experts to investigate the cause and scope of the breach.

- Notification Costs: Notifying affected customers, employees, and regulatory agencies.

- Credit Monitoring: Providing credit monitoring services to affected individuals.

- Public Relations: Managing the public relations aspect of the breach to minimize reputational damage.

Cyber Extortion

This coverage helps pay ransom demands in the event of a ransomware attack. It also covers the costs associated with negotiating with cybercriminals and recovering encrypted data. It's important to note that insurance companies often work with specialized negotiation firms to handle these situations.

Business Interruption

If a cyberattack disrupts your business operations, this coverage can help reimburse you for lost income and expenses. This can be crucial for small businesses that rely heavily on their IT systems to operate.

Liability Coverage

This coverage protects you from lawsuits filed by customers or other third parties who have been harmed by a data breach. This can include claims for negligence, breach of contract, and violation of privacy laws.

Regulatory Fines and Penalties

If your business is found to be in violation of data privacy regulations (such as GDPR or CCPA) as a result of a cyberattack, this coverage can help pay for fines and penalties.

Data Recovery

This coverage helps pay for the costs of restoring or recreating lost or damaged data. This is particularly important if your business relies on data to operate.

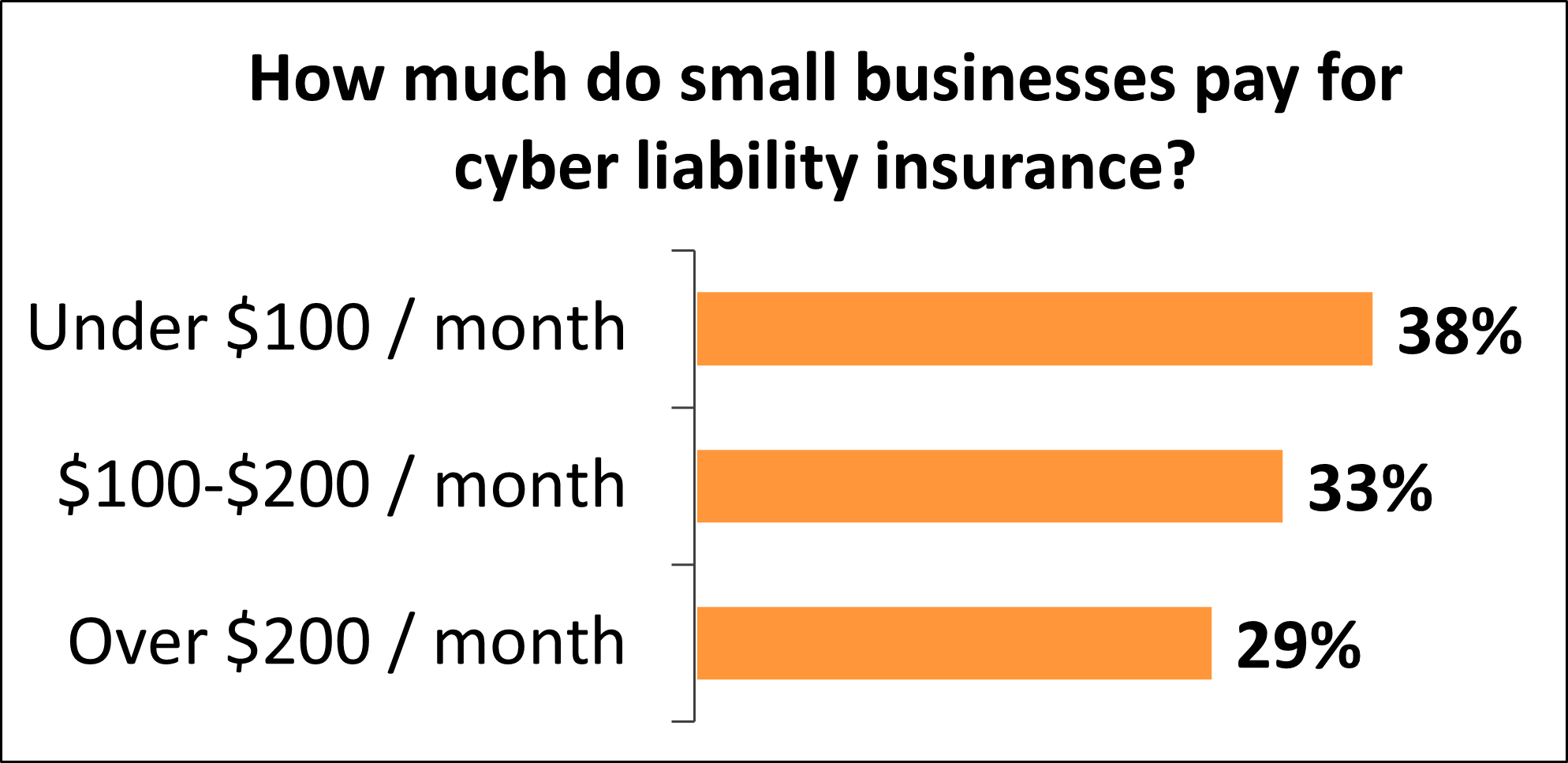

Factors Affecting Cybersecurity Insurance Premiums

The cost of cybersecurity insurance depends on several factors, including:

- Business Size: Larger businesses typically pay higher premiums than smaller businesses due to their larger attack surface.

- Industry: Certain industries, such as healthcare and finance, are considered higher risk and may pay higher premiums.

- Security Posture: Businesses with strong cybersecurity defenses typically pay lower premiums. This includes things like having strong passwords, implementing multi-factor authentication, and providing employee cybersecurity training.

- Coverage Limits: Higher coverage limits will result in higher premiums.

- Deductible: A higher deductible will result in lower premiums, but you'll have to pay more out of pocket in the event of a claim.

Choosing the Right Cybersecurity Insurance Policy

Selecting the right cybersecurity insurance policy requires careful consideration. Here are some tips to help you choose the right policy for your small business:

- Assess Your Risks: Identify your company's specific cybersecurity risks and vulnerabilities. This will help you determine the types of coverage you need.

- Compare Quotes: Get quotes from multiple insurance providers to compare coverage options and premiums.

- Read the Fine Print: Carefully review the policy terms and conditions, including exclusions and limitations.

- Work with an Insurance Broker: An insurance broker can help you navigate the complex world of cybersecurity insurance and find a policy that meets your needs.

- Consider Your Budget: Choose a policy that provides adequate coverage without breaking the bank.

Beyond Insurance: Strengthening Your Cybersecurity Posture

While cybersecurity insurance is an important tool for mitigating financial risks, it's not a substitute for strong cybersecurity practices. Small businesses should also take steps to strengthen their overall cybersecurity posture, such as:

Employee Training

Educate your employees about cybersecurity threats and best practices. This includes training on topics such as phishing, password security, and data privacy.

Strong Passwords and Multi-Factor Authentication

Require employees to use strong, unique passwords and enable multi-factor authentication for all critical accounts.

Regular Software Updates

Keep your software and operating systems up to date with the latest security patches.

Firewall and Antivirus Protection

Install and maintain a firewall and antivirus software on all computers and devices.

Data Backup and Recovery

Regularly back up your data and have a plan for recovering it in the event of a data loss.

Incident Response Plan

Develop an incident response plan that outlines the steps to take in the event of a cyberattack.

0 Comments